Number: SOP-TVL-17

Subject: Student Travel

Summary: Reimbursement and reconciliation of Student Travel.

Source: University Procurement Services

Date of Issue: 10/22/2024

Rationale

Student Travel is when a student is traveling on approved travel, for IU purposes, with no defined IU student group leader. Each traveler is responsible for their own expenses. This SOP is written to help with guidance during reimbursement and reconciliation.

Procedure

Student Travel is when a student is traveling on approved travel, for IU purposes, with no defined IU student group leader. Each traveler is responsible for their own expenses. Please note, each student must pay for their own expenses (meaning one student cannot pay and claim for reimbursement for another student, each expense must be incurred by and reported on the individual student’s Emburse Enterprise profile for proper routing and review of expenses).

Students can prepay their travel expenses either by using out-of-pocket funds or using an IU prepaid method. This can be done by having an arranger contact a local Destinated Travel Agency (DTA) and having the arranger book travel on behalf of the student. An Egencia account can be created for a student as well. The student will be able to log in and find the reservations they would like, but an arranger is required to go in and submit the reservations on the student’s behalf.

Upon return from the trip, a delegate will need to submit a reimbursement report on behalf of the student traveling.

Student Travel Business Purpose

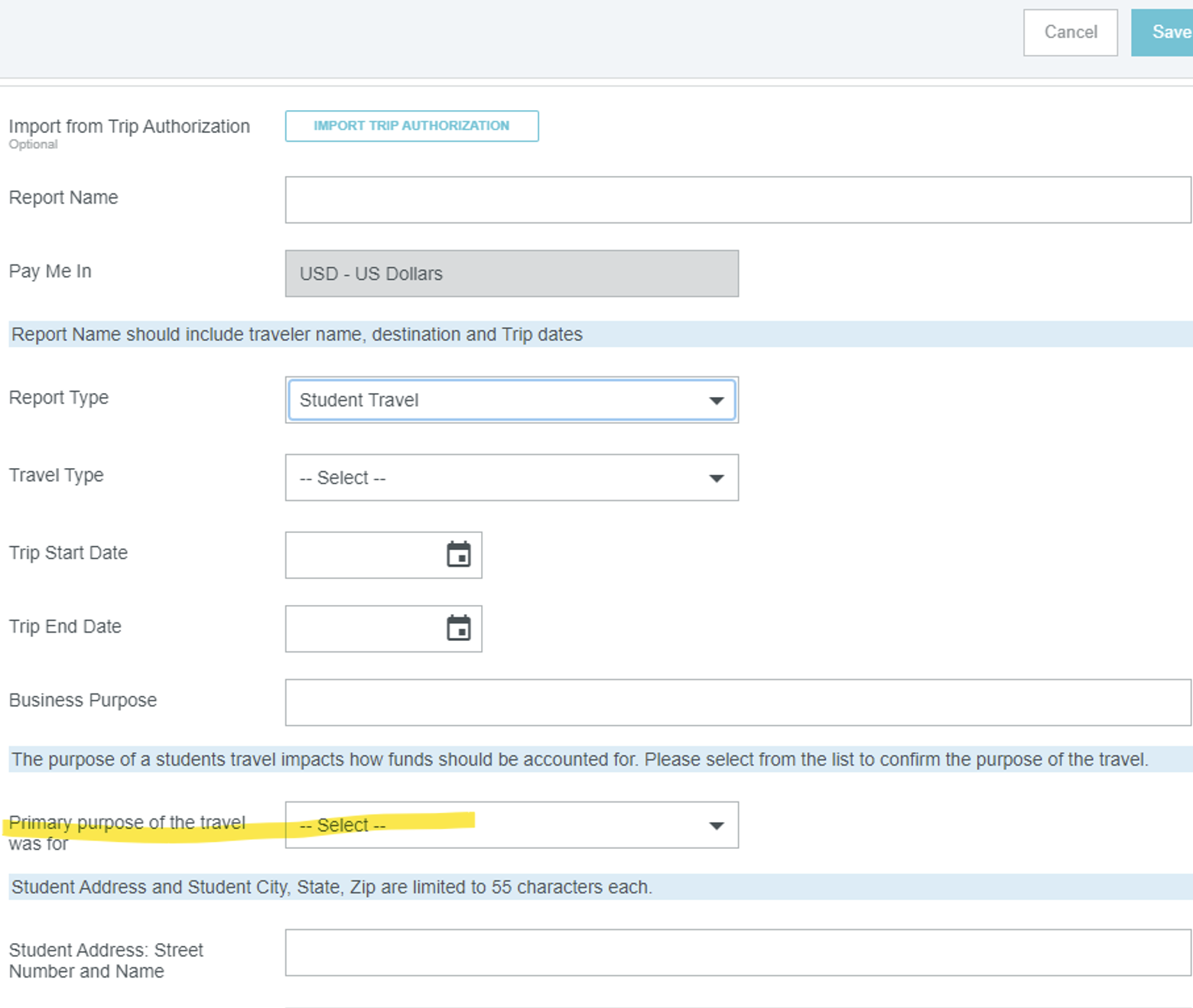

The main difference between submitting a student travel reimbursement report as opposed to an employee travel reimbursement report is the “primary purpose of the travel” field. The options are academic benefit, employment, IU business, and personal benefit. The selection of this field impacts how funds should be accounted for. Student Payment Guidelines should be referenced and contacted for questions about funding.

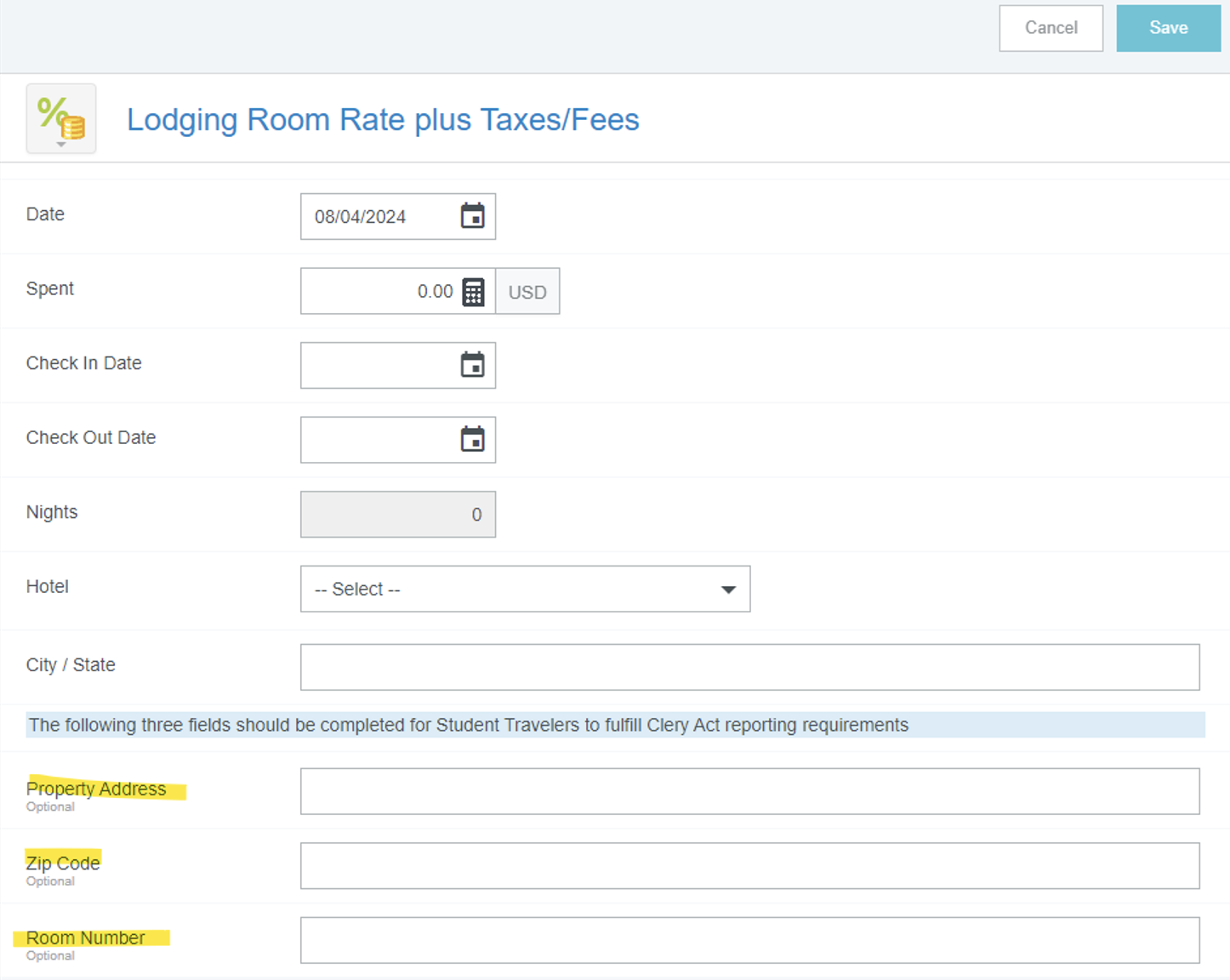

Student Travel Lodging Address for Clery Act Reporting

Another important aspect of a student travel report that should have close attention drawn to it is under the “Lodging Room Rate plus Taxes/Fees” section. There is a labeled as an “optional” section to enter the property address but is required for student travel reports. These fields help to fulfill Clery Act reporting requirements and allows for easy access to information as it can be pulled straight from the Emburse Enterprise system. More information on Clery Reporting can be found at https://protect.iu.edu/iu-police-department/campus-security-reports/jeanne-clery/index.html. If an Airbnb was utilized for lodging arrangements for the stay, the delegate should obtain the actual address for the Airbnb from the traveler so the exact address can be entered onto the report.

For a detailed walk through on how to create an expense report, please visit https://travel.iu.edu/pdf/Reimbursing-Travel-Expenses.pdf.

Definitions

- Reconciliation:

- Taking Emburse Enterprise eWallet items and adding them to an expense report with a funding account so money is pulled from appropriate IU account.

- Reimbursement:

- When a traveler pays out of pocket for an expense, the act of submitting appropriate documentation on a report to be paid back for personal funds spent while on university business.