Number: SOP-TVL-15

Subject: GSA Rates Lodging Reimbursements

Summary: Calculating lodging budget for a homestay like Airbnb or VRBO rentals.

Source: University Procurement Services

Date of Issue: 01/30/2024

Rationale

Some travelers prefer to book their own lodging accommodations and might prefer to stay in an Airbnb/VRBO type of rental. When this occurs, it is important to remember that lodging reimbursements are limited to single/standard room occupancy rates. Since Airbnb’s/VRBO’s are priced based on the occupancy/location/season etc. prices fluctuate, and can make applying travel policy of single/standard room occupancy rates challenging. With this in mind, this SOP is intended to help travelers navigate how to apply travel policy to a homestay lodging type of booking.

Procedure

The first step is to understand the reason for using Airbnb/VRBO type of rentals. These are common scenarios when booking an Airbnb/VRBO.

- Traveling alone-enjoy the house like living space.

- Traveling with other IU affiliated travelers. Trying to save money.

- Traveling with non-IU affiliated travelers and need a larger accommodation.

Each above scenario has different requirements when thinking about expense reporting.

1. Traveling alone-enjoy the house like living space.

If you find yourself staying in Airbnb type of rental due to personal preference, the size and amount of the Airbnb should be taken into consideration.

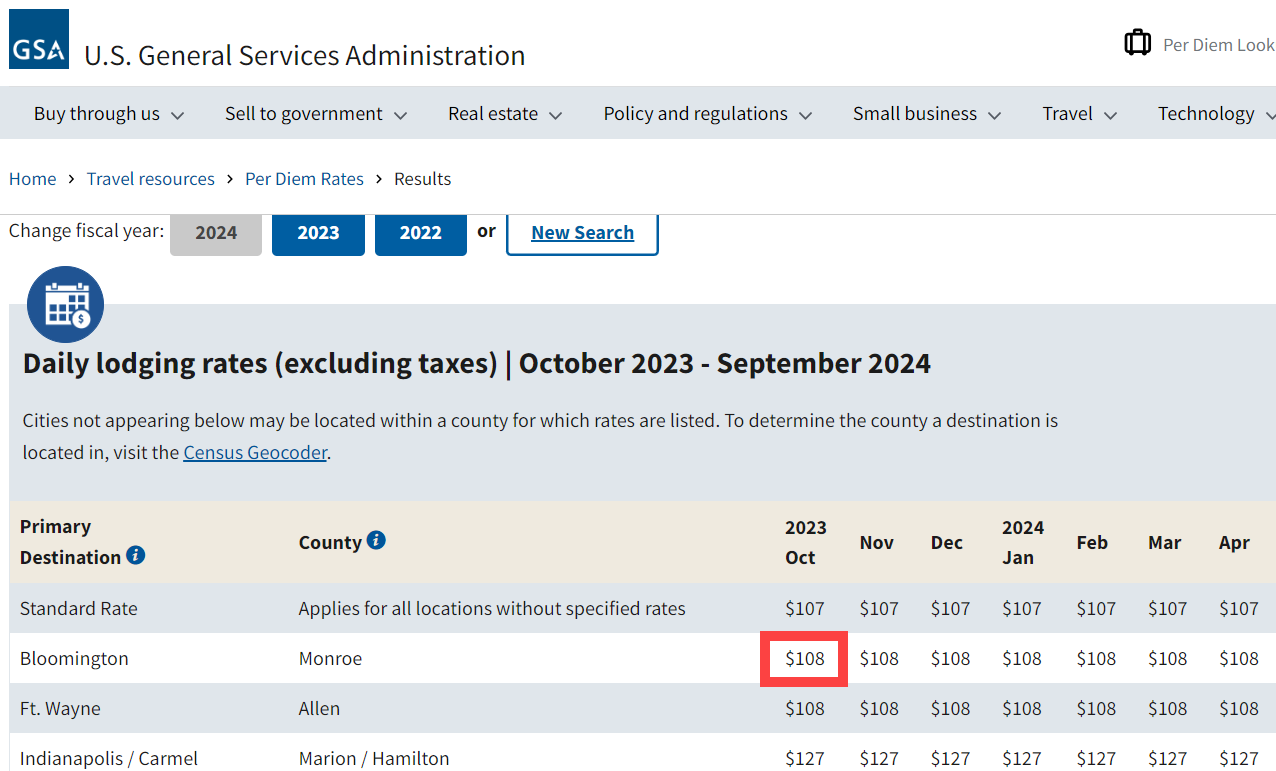

A standard hotel room comes in the category of the hotel’s cheapest room. It is a type of single room, which has a king-sized bed, or has two beds. The Airbnb/VRBO rental should be similarly equipped. An Airbnb/VRBO type rental should be less than the conference organizer’s discounted hotel rate, with business justification provided if higher than the conference hotel rate. The cost comparison, bed and guest descriptions should be notated on the Emburse Enterprise expense report. If the lodging accommodation is larger than the standard hotel room, it should be less than the General Services Administration (GSA) rate and that should be notated on the expense report. To look up the GSA rate for a night of lodging, please visit this link. If you find yourself staying in a Airbnb/lodging accommodation that is more than the GSA rate for the area, reimbursement should be limited to the GSA nightly rate. Cleaning fees/service fees can still be reimbursed, as long as they are standard fees, and not increased due to pets, etc.

2. Traveling with other IU affiliated travelers. Trying to save money.

If you find yourself traveling with a group and getting an Airbnb homestay to help reduce expenses, each IU traveler and affiliation must be notated on the expense report. If the expense is shared (split amongst travelers) please review SOP-TVL-14 for additional requirements. If there are IU affiliated travelers, and non IU affiliated travelers, the amount should be prorated for the IU affiliated employees only.

For example: 6 travelers stayed. 3 were IU affiliated. 3 were non IU affiliated. The cost was $600 for everyone. 6/$600 = $100 per traveler. $100 * 3 IU affiliated travelers = $300 total allowable reimbursement.

3. Traveling with non-IU affiliated travelers and need a larger accommodation.

If there are non IU affiliated travelers traveling with the IU affiliated traveler, IU will not reimburse these costs, due to them being personal in nature. If a traveler is planning to stay in an Airbnb/VRBO homestay, the lodging GSA rate for the trip location must be applied. This rate will be the maximum IU will reimburse, per night. Cleaning fees/service fees can still be reimbursed, as long as they are standard fees, and not increased due to pets, etc.

For example, in the receipt image below, it was a 3 bed, 2 guest Airbnb homestay. The second traveler is not an IU affiliated traveler. In this example, the nightly rate is $168.23. The nightly GSA per diem rate for October 2023 is $108 per night. That means that the nightly rate needs to be reduced to $108.00 as that is the set daily lodging rate, set by the GSA. Since the cleaning and service fees are standard here, they can be reimbursed as well. This means that $108/night * 3 nights = $324.00 + $36.59 (cleaning fee) + $33.68 (service fee) = $394.27 for reimbursement. The GSA rate should be notated on the Emburse Enterprise expense report.

If the lodging accommodation is less than the set GSA daily lodging rate, then IU will reimburse up to the amount spent. IU will not reimburse additional expenses, such as crib fees, pet cleaning fees, etc. Only standard cleaning fees and service fees will be reimbursed.

In this example, the nightly rate is $100.00 a night in Bloomington IN. The GSA daily lodging rate is $108.00 a night. This should be notated on the expense report that the 2nd guest was a non-IU affiliated traveler, but the GSA rate is $108.00 a night. In this example, IU would reimburse the total spent, of $370.27.