Number: SOP-TVL-09

Subject: Mileage Over 10 Stops

Summary: Request mileage reimbursement for a trip containing more than 10 stops.

Source: University Travel Management Services

Date of Issue: 11/08/2022

Date of Revision: 08/19/2025

Rationale

Business trips by personal car, especially research trips, can include multiple stops. Mileage is calculated per trip, not per day. Indiana University uses the mileage reimbursement rates set by the Internal Revenue Service (IRS). The reimbursement rate is determined by the number of miles traveled round trip. A higher rate is paid for mileage up to 500 miles. After 500 miles, a lower reimbursement rate is used. All destinations should be entered in a single mileage expense tile to ensure the correct rate is calculated.

However, the Emburse Enterprise mileage wizard only allows entry of up to 10 stops per mileage expense. When a trip has 11 or more stops, destinations beyond the 10th stop must be captured in another mileage expense tile. Additionally, If there are multiple mileage expense tiles and the total mileage of the trip exceeds 500 miles, the reimbursement rate for miles over 500 must be edited and reduced by the report approver.

This guide demonstrates how the traveler or travel arranger should enter mileage on the expense report as well as how the report approver should edit the report.

Procedure

Traveler/Travel Arranger Instructions:

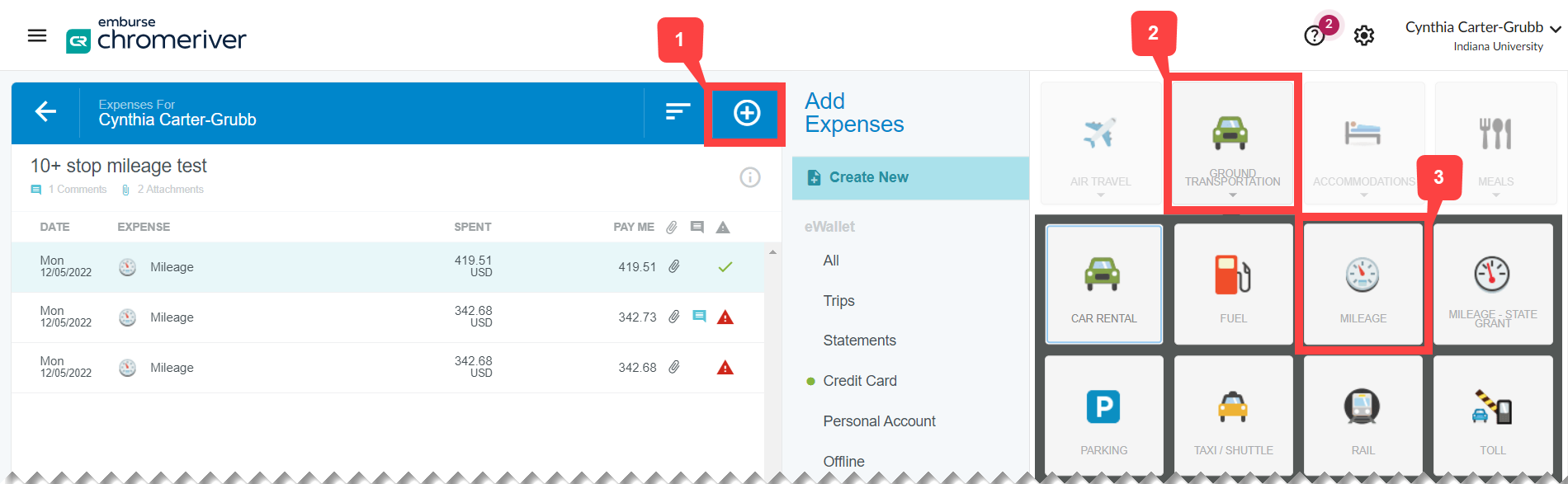

Review the Reimburse Mileage guide and follow the steps for an In State or Out of State mileage reimbursement. Continue adding stops to the mileage wizard tile until the maximum of 10 stops is reached. Save the mileage wizard tile, then add another mileage wizard to the expense report by clicking the encircled plus button, selecting Ground Transportation, then the Mileage tile.

In the new Mileage expense, use the last destination of the previous Mileage expense as the first destination. Repeat this process of adding a new Mileage wizard tile until all trip stops are accounted for.

If total mileage for the trip across all mileage tiles is less than 501 miles, add any additional expenses and submit the report. If total mileage exceeds 500 miles, follow the steps below to calculate the actual mileage reimbursement owed and leave notes for the report approver.

Emburse Enterprise calculates the mileage reimbursement for each Mileage expense using the IRS’s current reimbursement rate for the first 500 miles driven and the reduced rate for miles driven over 500. If trip mileage totals 501 or more miles over more than 10 stops, the correct reimbursement amount must be manually calculated and logged in the comments. The report approver will update the reimbursement amount.

Select each additional Mileage expense in the left pane and it opens in the right pane. Locate the Total Miles Driven.

Multiply the miles driven amount by the “501 miles or more” reduced rate on the Mileage Rates page.

In the example above, the true reimbursement amount owed to the traveler is 596.59 miles x $0.3125 which equals $186.44 (instead of $342.68). The reimbursement rate used in this example was current as of December 2022. Always review the Mileage Rates page referenced above for the most up to date rate.

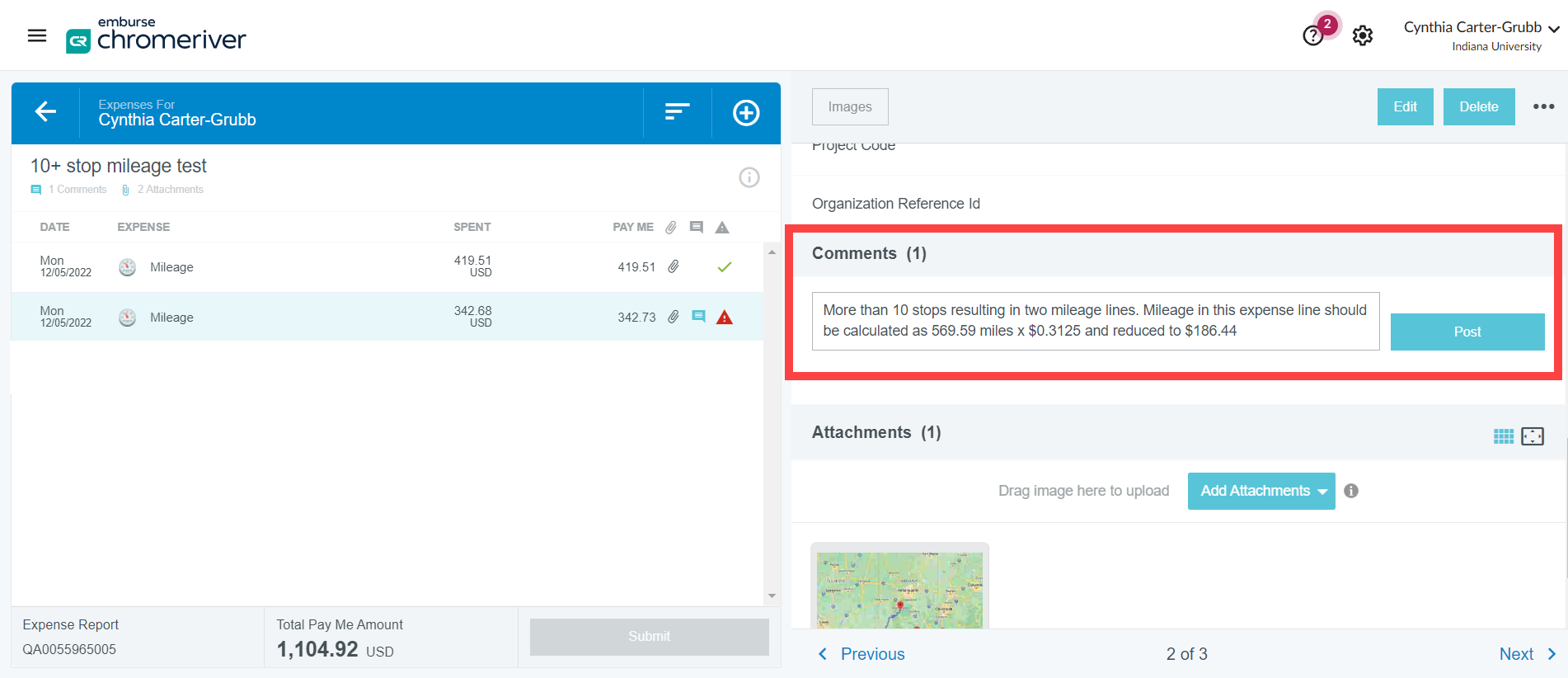

After calculating the true amount owed, scroll to the bottom of the right pane, and add a comment to the expense. Here, explain that the report approver should update the amount owed to what was manually calculated.

An example comment may look like: “More than 10 stops resulting in two mileage lines. Mileage in this expense line should be calculated as 596.59 miles x $0.3125 and reduced to $186.44.”

Click Post to save the comment to the expense.

Submit the expense report after all trip expenses are added.

Approver Instructions:

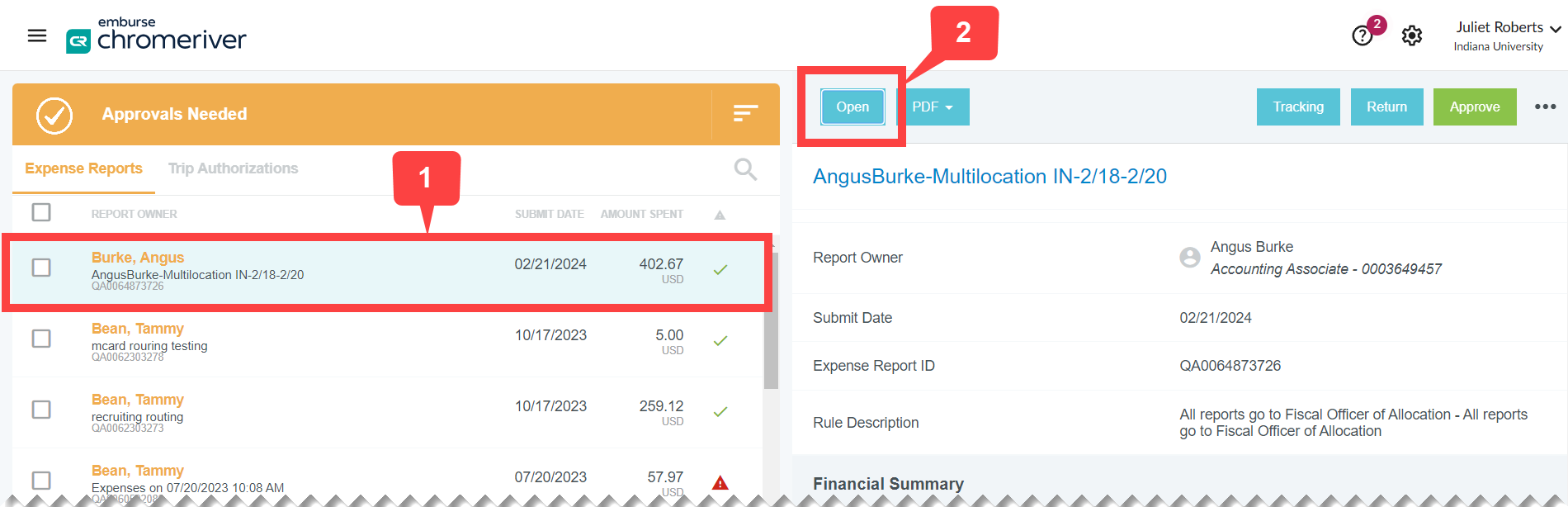

Approvers must update the amount due on the expense report. In the approvals ribbon, select the report in the left pane, then click Open in the right pane to view the full report.

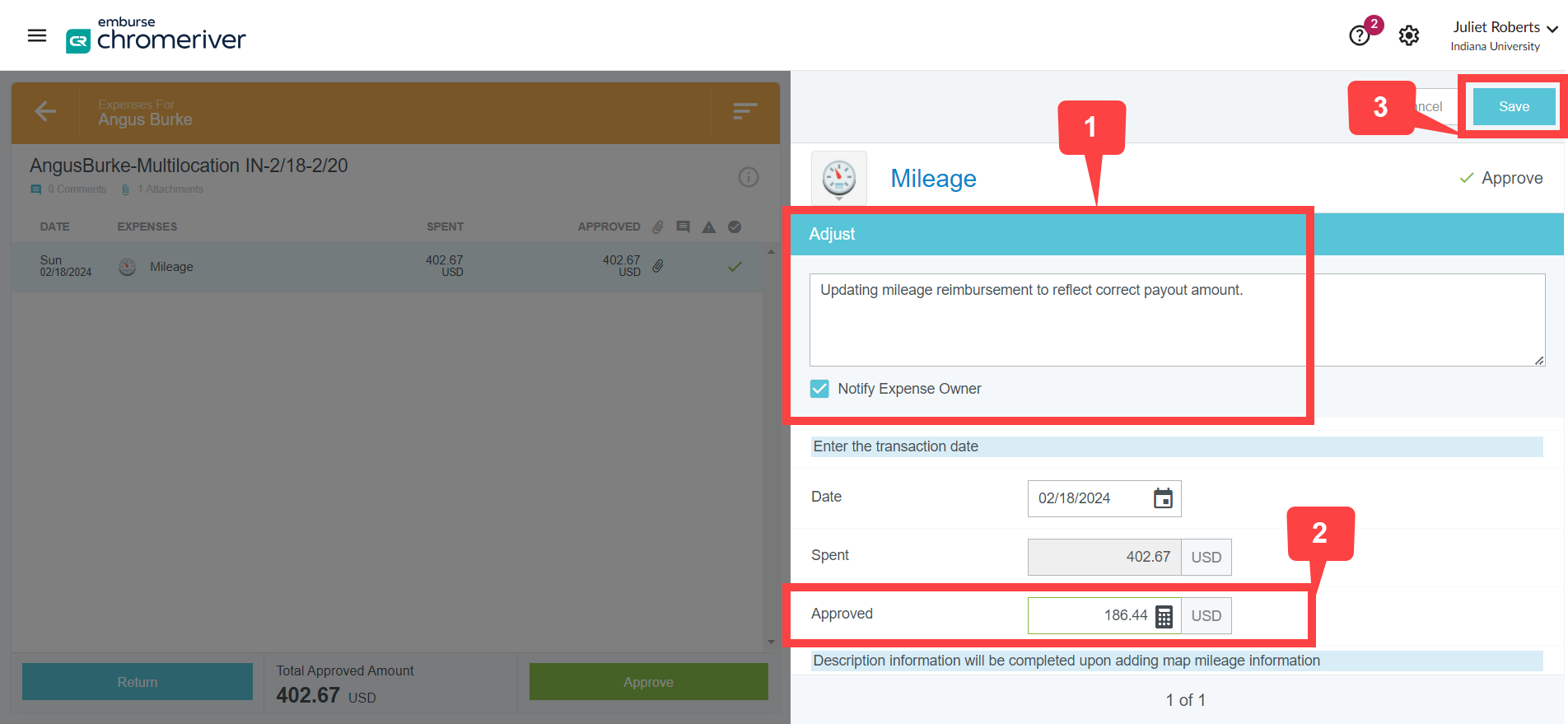

Select a mileage expense line from the left pane, then scroll to the bottom of the right pane and review the comment left by the report submitter to find the correct payout amount, then click the Adjust button at the top of the report.

Scroll to the top of the right pane and update the amount in the Approved field so it matches the amount noted in the comment. Enter a description of the change made in the Description field, then click Save. The expense owner will receive an email and be notified of the change.

The report updates to reflect the correct payout amount. Repeat these steps as many times as necessary.

Change Log

| Date | Change description | Completed by |

|---|---|---|

| 08/19/2025 | Add language to clarify that mileage should be captured round trip and in a single expense tile, unless the trip has 10+ stops. This ensures the calculator is using the correct (reduced) amount if mileage exceeds 500 miles. | Priscilla Laird, Juliet Roberts |