Number: SOP-PURCH-19

Subject: BUY.IU Receiving

Summary: Requirements for BUY.IU receipt documents.

Source: University Procurement Services

Date of Issue: 10/10/2019

Date of Revision: 03/16/2023

Rationale

Use of Receiving functionality in BUY.IU

Background

Receiving functionality is used in BUY.IU to systemically verify receipt of goods or services. This functionality strengthens internal controls and improves efficiency by allowing users to electronically verify the goods or services with minimal data entry. Receipt information must be used when determining if invoices should be paid.

The term “receipt” can be misleading. This term refers to the BUY.IU receipt document, not a physical receipt provided by the supplier, though a physical receipt or packing slip may be scanned and attached to the BUY.IU receipt document.

Users can track the receipt and return of goods/services to ensure appropriate use of IU funds in accordance with all IU Purchasing policies and standard operating procedures.

Receiving is required for all purchase orders totaling $5,000 and over, all orders to suppliers with foreign currency class, and on all subawards.

Procedure

As items are received, returned, or cancelled, users generate an electronic receipt document to track the activity. Receipts are automatically populated with purchase order (PO) data including quantity/cost. Additional shipping information such as the shipping method, tracking number, or packing slips may be manually entered at the department’s discretion.

All active IU employees may create a receipt document in BUY.IU.

There are two types of receipts: Quantity receipts and Cost receipts.

- Quantity Receipts: These are mainly used when ordering goods from a supplier. BUY.IU maintains a running total of the quantity of goods received, returned, or cancelled. Totals are automatically adjusted with each subsequent receipt associated with the order. This helps reduce the risk of payment for under-received, damaged or over-shipped items.

- Cost Receipts: These are mainly used to track goods/services related to recurring orders and capital asset orders. Cost receipts allow users to receive a monetary amount rather than a quantity.

A receipt can also be used to indicate that an item(s) will NOT be received (cancelled) or have been returned to the supplier.

Note: Once quantities/amounts have been marked cancelled on a receipt, the PO no longer reflects those quantities/amounts as available for future receipts. If quantities/amounts previously cancelled are marked as received on future receipts, BUY.IU will consider the order over-received.

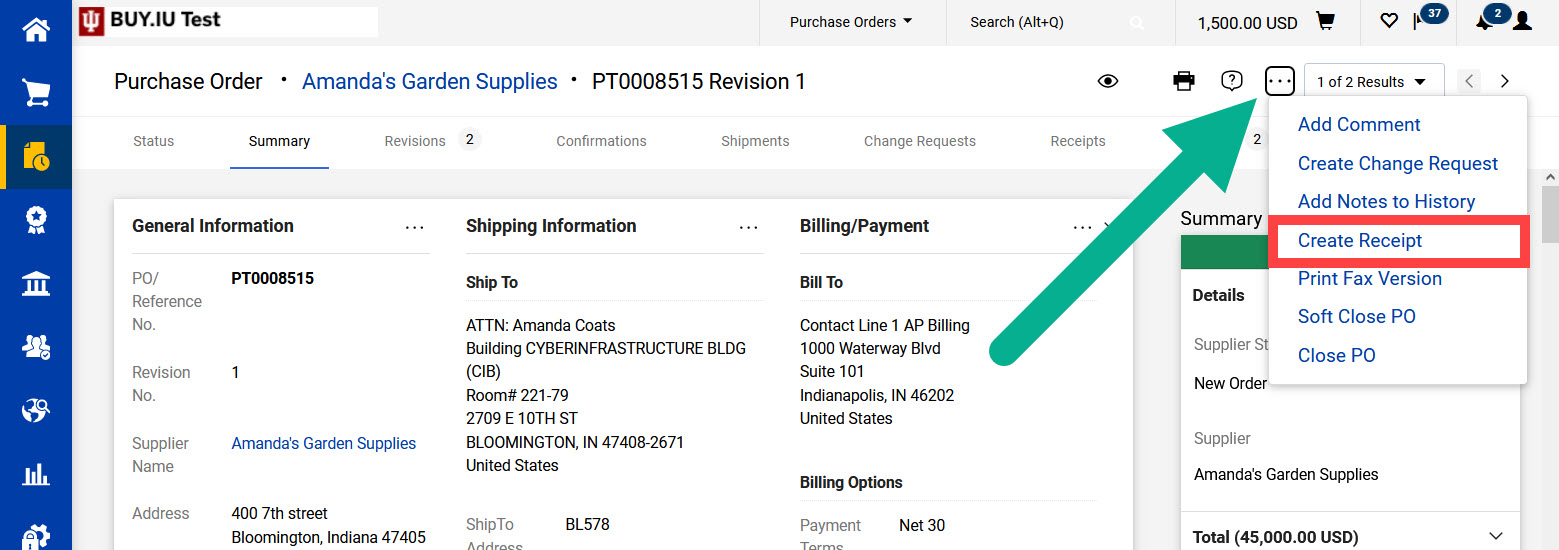

To initiate a Receipt, click Document Actions on the Purchase Order in BUY.IU then select Create Quantity Receipt or Create Cost Receipt as appropriate.

Note: Generally, only one receipt type will be available in the Document Actions carrot. If more than one receipt type is listed, BUY.IU will redirect you to the correct receipt type.

Partial Receiving:

A department may receive a partial shipment for a PO due to backordered or discontinued items. In this event, individual line items can be removed from the receipt specifying only the goods and services received. Each time goods and services are received for the PO, additional partial receipts can be created until the PO has been fully received.

Over-Receiving:

If the user enters a quantity on a line that is greater than what is on the PO, an over-received warning will display. The over-received warning is not an error. If the order is over received by mistake and the receipt cannot be deleted because the invoice has already moved to OK to Pay, a comment should be added notating the receipt was created in error.

Returns:

Indicate that goods/services were received and taken into possession but are now being returned. A field is available to enter a return authorization number along with reason for returning. These fields are available but are not required. The functionality for returning items is only available when using a quantity receipt. Returns associated with cost receipts will need to be noted in the comments section of the PO if it is anticipated that the items will be received in the future. Users should not select “Cancelled” on cost receipts in lieu of Returned.

Cancelled Orders:

Indicate that goods/services will not be received (i.e. if a product was discontinued) or were immediately returned upon shipment where IU did not take possession. The cancelled option should only be used if you do not anticipate receiving the goods/services in the future.

Standard Purchase Order Receiving (Includes Capital Purchases):

The PO amount determines if receiving is required prior to the supplier invoice moving to the OK to Pay status.

PO amount is less than $5,000

- Receiving is not required but may be completed by the department if desired.

- Matching:

- PO on supplier-provided invoice matches PO in BUY.IU.

- Invoice line-item values are within 10% or $250 (whichever is less) of corresponding PO line item, as approved by the University Controller.

- Invoice line-item quantities are within 10% of corresponding PO line item.

- If all rules are met, the supplier invoice will automatically move to OK to Pay.

- Example:

- A purchase order is placed for 15 items from a Purchasing approved supplier.

- Each item costs $250 so the total amount of the purchase order = $3,750

- Two invoices have been received:

- The first invoice is for 7 items = $1,750

- The second invoice is for the remaining 8 items = $2,000

- Since the purchase order total is under $5,000 and both invoices were within the 10% or $250 tolerances, the invoices moved straight to OK to Pay without review. The department may choose to create receipts for both invoices in BUY.IU, but receipts are not required for payment to be released for these invoices.

- Example:

PO amount is greater than or equal to $5,000

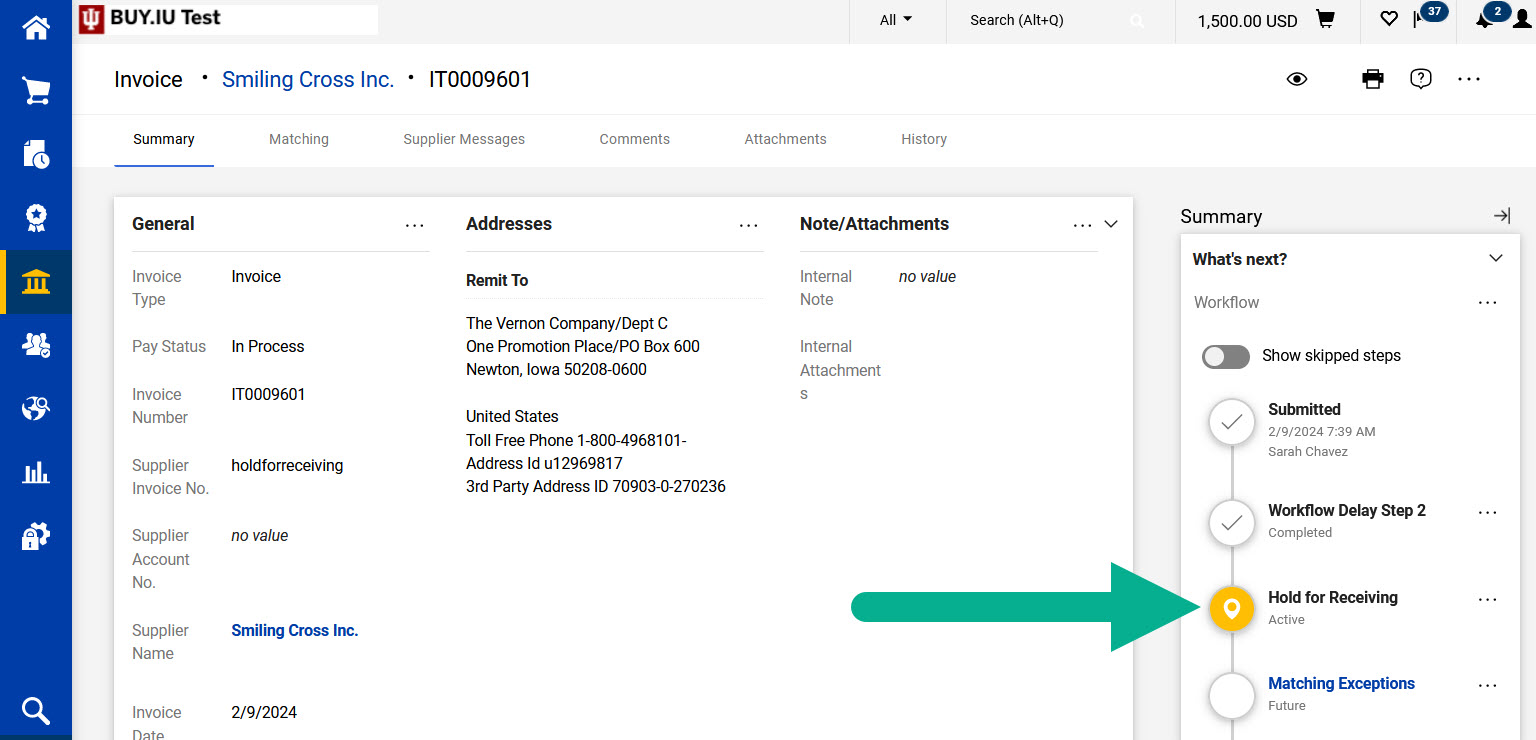

Receiving is required on all orders before a supplier invoice can move to the OK to Pay workflow step. The invoice will stay in the Hold for Receiving workflow stop until a receipt is created, at which time the invoice will move forward to the OK to Pay workflow step (if no other exceptions triggered).

Note: Purchase Orders containing capital asset purchases require cost receipts.

- Matching:

- PO on supplier-provided invoice matches PO in BUY.IU.

- Invoice line-item values are within 10% or $250 (whichever is less) of corresponding PO line item, as approved by the University Controller.

- Invoice line-item quantities are within 10% of corresponding PO line item.

- Receipt document logged on PO, which meets or exceeds quantities/costs invoiced.

- When all conditions are met, the supplier invoice will automatically move to OK to Pay.

- Example:

- A purchase order is placed for 520 items from a Purchasing approved supplier.

- Each item costs $20 so the total amount of the purchase order = $10,400

- The first invoice received is for 150 items = $3,000

- Because the purchase order total is over $5,000, a receipt must be created for the quantity of items received or the $3,000 invoice will not move to OK to Pay in BUY.IU.

- The department has only received 120 items and will create a receipt to match. The invoice will remain in the “Hold for Receiving” workflow stop until a receipt is created for the remaining 30 items. The quantity/cost invoiced must match or be within the 10% or $250 tolerance of the quantity/cost received before the invoice will move to OK to Pay.

Sub-award Order Receiving:

Receiving is required on all sub-award orders, regardless of the dollar amount, before a supplier invoice can move to the OK to Pay workflow step. The invoice will stay in the Hold for Receiving workflow stop until a receipt is created, at which time the invoice will continue routing. Subaward POs are generally established as Recurring Payment Orders, which require a cost receipt.

- Matching:

- PO on supplier-provided invoice matches PO in BUY.IU.

- Invoice line-item value does not exceed PO line-item value.

- Receipt document logged on PO, which meets invoiced amount.

- When all conditions are met, the supplier invoice will automatically move out of Hold For Receiving.

- Example 1:

- A recurring sub-award PO is placed with supplier for 10,000.

- Supplier submits an invoice for 1,000.00.

- Invoice stops at Hold For Receiving.

- PO Owner receives a notification that a receipt is needed.

- PO Owner or other individual performs required research and logs a cost receipt for 1,000.00.

- Invoice routes out of Hold for Receiving (does not stop at Match Exception if no other exception triggered).

- Example 2:

- A recurring sub-award PO is placed with supplier for 10,000.

- Supplier submits an invoice for 1,000.00.

- Invoice stops at Hold For Receiving.

- PO Owner receives a notification that a receipt is needed.

- Receipt is not created before Receiving Lead Time expires (see below).

- Invoice routes out of Hold For Receiving to Match Exception for Fiscal Approver review.

- Fiscal Approver contacts PO Owner and prompts them to log receipt for 1,000.00. Fiscal Approver confirms receipt has been logged for 1,000.00.

Receiving Lead Time

- Ten days before an invoice’s due date, the invoice will move out of the Hold for Receiving workflow stop into the Match Exceptions workflow stop if a receipt is not created by this date.

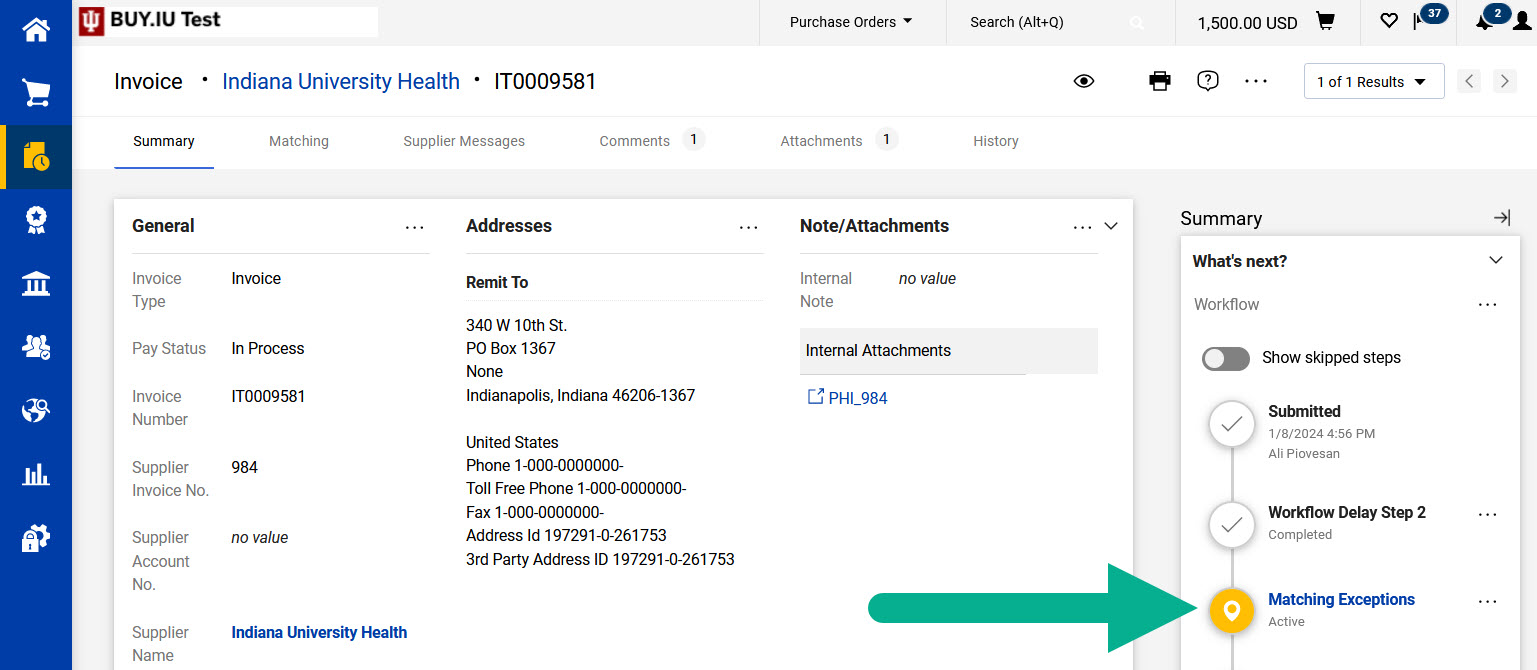

- Members of the Match Exceptions workflow stop (Fiscal Approvers) are responsible for following up with PO Owner to instruct them (or whomever received the good/service) to create a Receipt in BUY.IU. Invoices without proper receipt documents should not be approved.

- Once appropriate receipts have been logged, the supplier invoice will be marked as Approved by BUY.IU, move out of the Matching Exceptions workflow stop and continue routing to OK to Pay status (if no other exception exists). If additional mismatches are present (such as discrepancies between the PO and invoice amounts) the invoice will require approval.

Note: While the Hold for Receiving workflow stop reflects a Completed status, a receipt is still required to be entered.

Recurring Order Receiving:

Recurring Payment Orders are used to establish a single Purchase Order that will be used for a designated period. Examples of such orders: 1) Recurring purchases as needed for goods; 2) Scheduled payment orders for leases; 3) Services with multiple milestones or invoices.

Recurring orders require receiving on invoices greater than or equal to $5,000.

Note: Recurring order invoices greater than or equal to $5,000 route to the Recurring Payment Review workflow stop. This stop, as approved by the University Controller, maintains adequate internal controls and prevents the invoice from moving to OK to Pay prior to approval. It is the Fiscal Approver’s responsibility to ensure the appropriate receipt has been created in BUY.IU before the invoice is approved for payment.

Example:

- A recurring purchase order is placed for a total encumbrance of $25,000 from a Purchasing approved supplier.

- The first invoice received is for $6,000.

- Since the invoice total is over $5,000, a cost receipt must be created for the value of the items received before the Fiscal Approver approves the invoice. If items referenced on the invoice are received in increments, i.e. $2,000 worth of goods is received in the current week and $4,000 worth of goods are received the following week, two receipts should be created before the invoice is approved to go OK to Pay.

- Note: Partial payments cannot be made against BUY.IU invoices. Fiscal Approvers should not approve invoices out of the Recurring Payment Review workflow stop until all goods have been received and the appropriate receipts are created.

Foreign Currency Order Receiving:

Any order to a Foreign Currency class supplier requires a receipt, regardless of the invoice amount. A cost or quantity receipt may be required depending on the type of order placed. Quantity receipts function the same as non-Foreign Currency class supplier orders. Cost receipts must be logged in the supplier’s preferred, non-US, currency.

Example:

- A recurring order is placed with a Foreign Currency class supplier for 5,000 pesos (MXN).

- The supplier submits an invoice for 2,500 MXN.

- The PO Owner receives a notification that a receipt is needed.

- PO Owner or other individual logs a receipt for 2,500 MXN (see example below).

- Prior to invoice approval, Fiscal Approvers confirms receipt has been logged which accounts for amount being charged.

Receiving Requirements Summary:

“Forced” receiving generates email reminders to the PO Owner notifying them that action is required.

| Order Type | Receiving Required? | Receiving forced by BUY.IU? |

|---|---|---|

| Standard Order <= $4,999.99 | No | No |

| Standard Order >= $5,000.00 | Yes, regardless of invoice value | Yes |

| Recurring Order | Yes, if invoice value is >= $5,000.00 | No |

| Subawards | Yes, regardless of invoice value | Yes |

| Check Requests | No, unless using Purchases for Resale >= $5,000.00 | Yes |

| Foreign Currency Orders | Yes, regardless of invoice value | Yes |

BUY.IU Receiving Requirement Exceptions:

Exceptions to this standard operating procedure require the approval of the Office of Procurement Services and the Office of the University Controller.